Rare Earth Elements Turkey: Strategic Insights for 2024

**The National Intelligence Academy has released an important analysis focused on the geopolitical significance of rare earth elements (REE) in Turkey and beyond, entitled ‘Rare Earth Elements and Turkey: New Dynamics and Actors in Geopolitical Chess.’ This comprehensive report emphasizes the vital role that REE play in the ongoing global energy transition. They are essential not only for the tech industry—powering electric vehicles, wind turbines, and electronic devices—but also for critical applications within the defense sector. Furthermore, projections reveal that the market for critical minerals could surge from $325 billion in 2024 to an astounding $770 billion by 2040, revealing just how integral these resources have become.

The analysis outlines the enormous financial reach of the REE-based electronics and motor industry, which has already exceeded the $1 trillion mark. This underscores the urgent need for nations to secure their supplies of these crucial materials.

China’s Dominance in Rare Earth Markets

The study draws attention to China’s overwhelming influence in the global REE marketplace, asserting that by 2024, China will account for an astonishing 61% of worldwide REE ore production and a staggering 92% of refining capabilities. The report identifies China’s strategic model of ‘produce, restrict, license’ as a key factor maintaining its market control, allowing it to dictate global pricing trends.

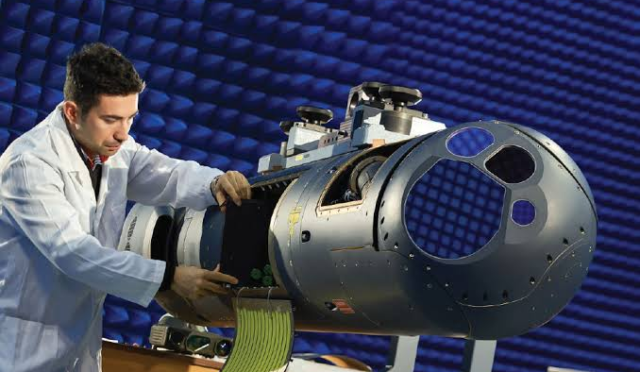

Furthermore, the analysis highlights the concerning dependency of the United States on China’s REE imports, noting that between 2020 and 2023, approximately 70% of the U.S. REE needs were met by Chinese suppliers. This dependency is underscored by the monumental quantities of REE required for military equipment, such as 410 kilograms for an F-35 fighter jet, 2.36 tons for an Arleigh Burke-class destroyer, and 4.17 tons for a Virginia-class submarine. Such figures illustrate that any disruption in supply could severely compromise U.S. defense capabilities.

U.S. Efforts to Bridge the REE Gap

To mitigate its reliance on Chinese imports, the United States is actively pursuing strategies to bolster its domestic REE capabilities. As outlined in the analysis, a new approach involving a ‘half-and-half joint fund’ model has been adopted in partnership with Ukraine, replacing a previously proposed $500 billion repayment plan. This pivot allows the U.S. to tap into Ukraine’s 5% global REE reserves as a promising alternative supply route.

However, challenges remain, as around 40% of these reserves are situated in conflict-affected areas controlled by Russia. The ongoing war has significantly damaged infrastructure, likely hindering immediate production. Additionally, deposits rich in dysprosium and terbium located in Greenland have emerged as another strategic focus for the U.S. in its quest to address the heavy REE shortfall.

Turkey’s Ambitious Goals in REE Production

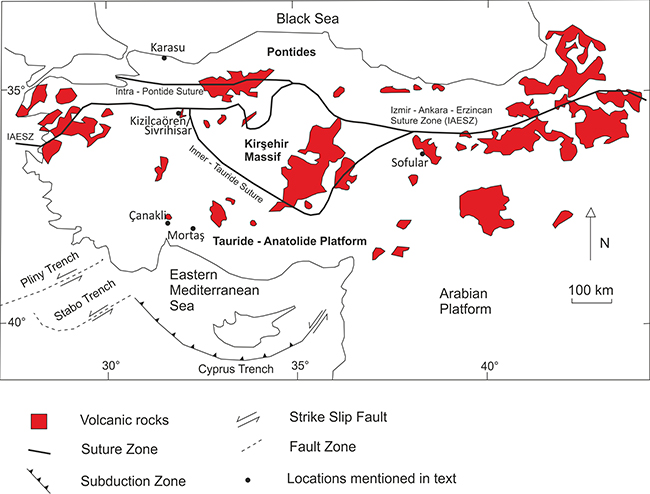

The National Intelligence Academy’s analysis dedicates considerable attention to Turkey’s significant REE resources. The report reveals that Turkey is sitting on approximately 694 million tons of REE reserves in Beylikova, Eskişehir, establishing the country as the second largest REE field globally, just after China. To capitalize on this potential, Turkey aims to operate a pilot facility with a capacity of 10,000 tons annually, with long-term aspirations of ramping up its purification capacity to an impressive 570,000 tons per year.

This ambitious plan signifies Turkey’s intention to emerge as a leading player in the REE market, particularly in Europe and the surrounding regions. The analysis outlines a three-part strategy aimed at not only possessing significant reserves but also adding value over the next decade. This strategy includes implementing JORC/UMREK-compliant verification processes, building scalable refining infrastructure, investing in advanced magnetic alloy research and development, as well as integrating circular recovery methods.

REE as Geopolitical Leverage

The analysis makes it clear that rare earth elements have transcended traditional economic roles; they have evolved into instruments of geopolitical leverage and strategic advantages. The report argues that in this competitive landscape, diversifying the global supply chain is essential, alongside the rapid incorporation of emerging producers and processing entities like Turkey, Ukraine, and Greenland.

Ultimately, the report concludes that the global competition is intensifying, not just in mining but significantly within the domains of refining, magnet manufacturing, and advanced technological production. As nations vie for control over these valuable resources, the stakes will only continue to rise.